Tax season is here, bringing a surge of potential buyers ready to spend their refunds. For many, tax refunds serve as the perfect opportunity to purchase a new or used vehicle, especially if they have been waiting for the financial boost. This period presents a prime opportunity for dealerships to increase sales, move inventory, and bring in new customers.

However, capitalizing on tax season requires strategic planning, marketing, lead management, and an optimized sales process. With competition high and customers actively searching for the best deals, dealerships must ensure they are fully prepared to capture and convert these leads.

In this guide, we’ll cover key strategies for car dealers to maximize tax season sales and how Get My Auto’s suite of solutions—including Ava AI, DMS+, CRM, and marketing automation—can help streamline operations and drive revenue.

1. Know Your Tax Season Buyers

Understanding who your tax season buyers are and what motivates them is critical to shaping an effective sales strategy. Buyers who enter the market during tax season generally fall into the following categories:

- First-time car buyers: Many consumers, particularly younger individuals or those with limited credit history, use their tax refunds as an opportunity to purchase their first vehicle.

- Buyers looking for a low down payment option: Some consumers may not have significant savings throughout the year but use their tax refunds as a way to afford a down payment on a vehicle.

- Credit-challenged buyers: Tax season buyers often include individuals with lower credit scores who rely on dealerships that offer flexible financing options.

- Customers seeking an upgrade: Some buyers have been waiting for their tax refund to trade in their older vehicle for a newer model.

By identifying these customer types, dealerships can tailor their marketing, financing offers, and lead follow-up strategies to better address buyers’ needs.

2. Optimize Digital Marketing for Tax Season Buyers

With tax refunds arriving, shoppers are actively searching for vehicles online, comparing deals, and looking for the best financing options. To stay competitive, dealerships must ensure that their digital marketing strategy is set up to attract and convert these high-intent buyers.

Run Targeted Digital Ads

Digital advertising is one of the most effective ways to capture tax season car shoppers. Dealerships should:

- Launch Google Ads campaigns targeting searches such as “buy a car with tax refund” and “best tax season car deals.”

- Use Facebook and Instagram ads to target local buyers with promotions such as “Use Your Tax Refund as a Down Payment.”

- Retarget website visitors who showed interest in a vehicle but haven’t made a purchase yet.

Leverage Social Media Engagement

Beyond paid ads, dealerships should use organic social media marketing to create engagement and drive leads. This includes:

- Posting customer testimonials from previous tax seasons.

- Running special tax season promotions that highlight financing options.

- Sharing educational content like “How to Use Your Tax Refund to Buy a Car.”

Optimize Your Website for Conversions

- Ensure vehicle listings are updated and mobile-friendly since many shoppers browse on their phones.

- Create a dedicated “Tax Refund Specials” page to highlight promotions.

- Implement a live chat or AI chatbot to answer customer questions instantly.

How Get My Auto Helps: Ava AI automates lead engagement across multiple platforms, responding to inquiries instantly via website chat, Facebook Messenger, and SMS to increase conversions.

3. Improve Lead Management and Follow-Up Speed

During tax season, customers are shopping around and making quick decisions. If a dealership fails to follow up with a lead promptly, the buyer is likely to move on to a competitor.

Follow Up Within Minutes

- Leads should be contacted within 5-10 minutes of submitting an inquiry.

- Sales teams should use automated SMS and email responses to keep buyers engaged.

- A CRM should be in place to track all customer interactions, ensuring that no leads slip through the cracks.

Use AI to Handle Increased Volume

Tax season means a spike in lead volume, making it difficult for sales teams to keep up manually. AI-powered tools can:

- Automate initial responses to new leads.

- Schedule test drive appointments based on customer availability.

- Send reminders and follow-up messages to reduce no-shows.

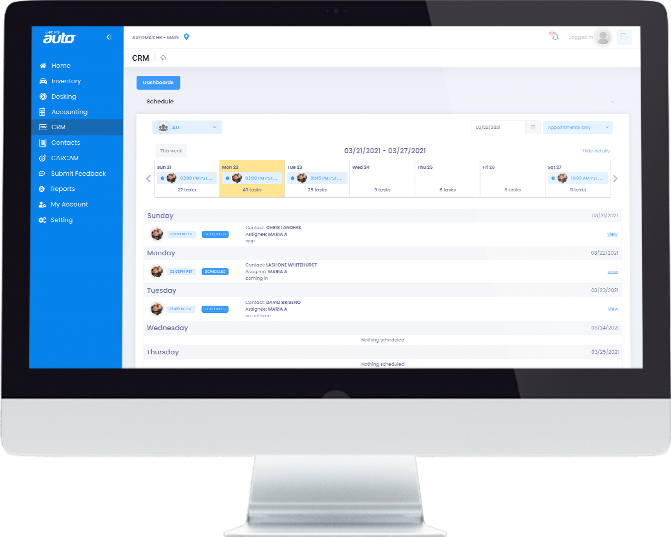

How Get My Auto Helps: The Get My Auto CRM automates lead follow-up, assigns tasks to sales teams, and ensures no customer inquiries are lost in the process.

4. Streamline the Financing and Approval Process

Many tax season buyers rely on financing to purchase a vehicle. If the financing process is slow or complex, buyers may abandon the purchase or turn to another dealership.

Offer Flexible Financing Options

- Work with subprime lenders to accommodate buyers with lower credit scores.

- Provide instant pre-qualification on your website.

- Allow tax refunds to be used as down payments with special promotions.

Speed Up Loan Approvals

- Use digital document processing to reduce paperwork delays.

- Offer e-signatures so buyers can complete forms remotely.

- Implement AI-powered fraud detection to quickly verify buyer information.

How Get My Auto Helps: The DMS+ system integrates financing tools, streamlines paperwork, and reduces approval times, improving the customer experience.

5. Ensure Inventory Is Ready for Increased Demand

With more buyers in the market, dealerships need to optimize inventory selection and pricing to meet demand.

Stock High-Demand Vehicles

- Review past tax season sales data to determine which models sold best.

- Increase inventory of budget-friendly vehicles in the $5,000 - $15,000 range.

- Promote trade-in incentives to acquire used cars that sell well.

Turn Inventory Faster with AI-Powered Pricing

- Adjust vehicle pricing based on real-time market demand.

- Use AI-driven pricing recommendations to remain competitive.

- Track inventory turnover rates to prevent overstocking slow-moving models.

How Get My Auto Helps: DMS+ provides real-time inventory insights and automates pricing strategies, ensuring dealerships stay competitive.

6. Reduce No-Shows and Keep Your Sales Floor Busy

One of the biggest challenges during tax season is reducing appointment no-shows. To keep sales floors active and engaged, dealerships should:

- Send automated appointment reminders via text and email.

- Offer priority scheduling or incentives for confirmed appointments.

- Call customers same-day to reconfirm interest and handle objections.

How Get My Auto Helps: Ava AI sends timely reminders and personalized follow-ups, ensuring more scheduled buyers actually show up to finalize their purchases.

Make Tax Season a Success with the Right Technology

Tax season presents an enormous opportunity for dealerships to increase sales, capture new customers, and optimize operations. However, success requires strategic marketing, fast lead follow-up, a seamless financing process, and an optimized inventory strategy.

By leveraging Get My Auto’s technology solutions, dealerships can:

- Automate lead response and appointment scheduling with Ava AI.

- Streamline CRM and customer tracking for better follow-up.

- Optimize inventory and pricing strategies with DMS+.

- Enhance financing and approval efficiency for faster deals.

With the right tools in place, dealerships can maximize tax season sales and create a smoother, more profitable customer experience. Now is the time to prepare and take full advantage of the influx of buyers looking to make a purchase. If you are an auto dealer, contact Get My Auto today to see how we can help.

Share this article

Help others discover this content