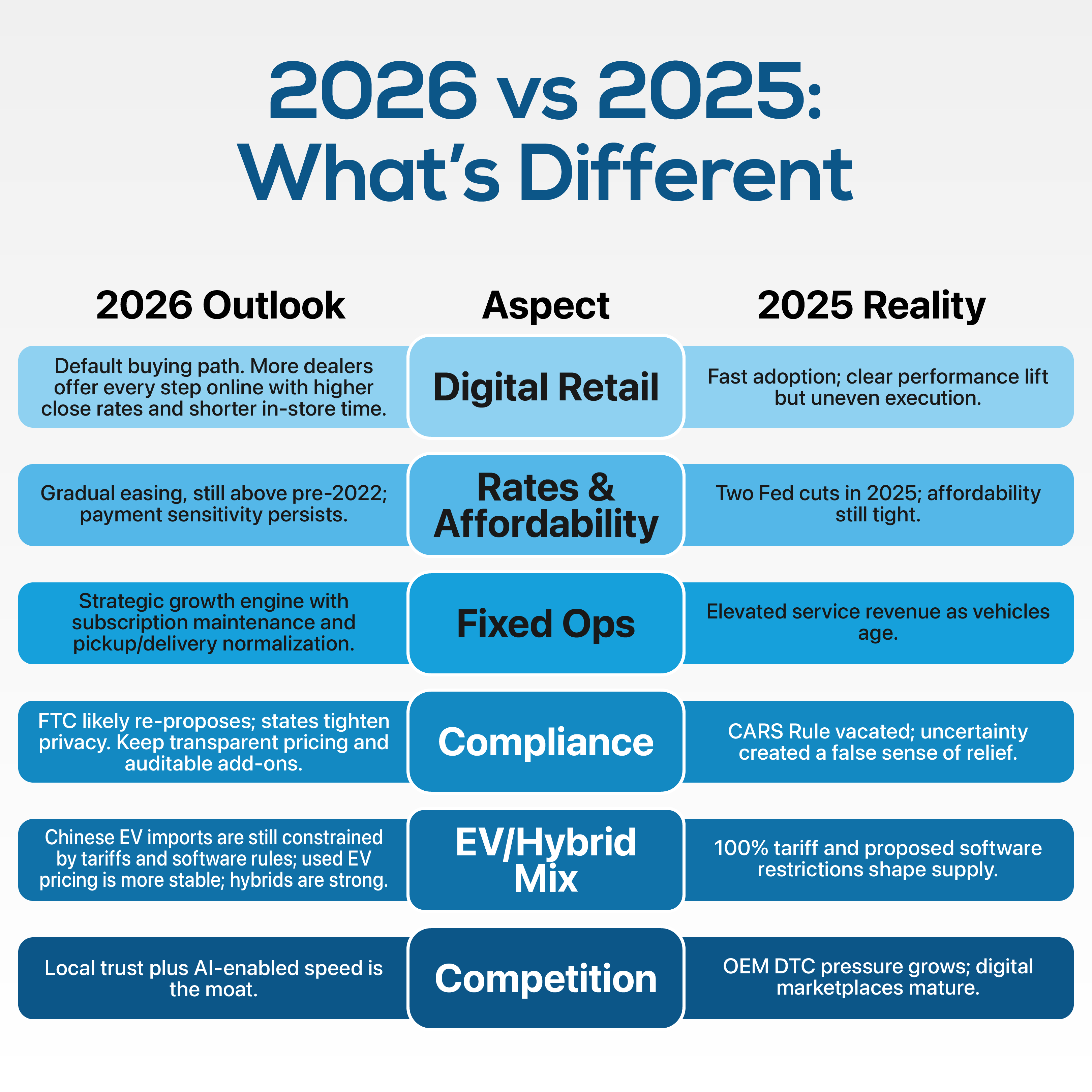

Independent auto dealers in 2026 will operate in a tighter, faster market. Profit pools move from front-end grosses to fixed ops and F&I efficiency. Digital retailing becomes the default, not a differentiator. Interest rates should ease modestly, but affordability remains a headwind that keeps used-vehicle demand value-focused. The regulatory picture resets after the FTC CARS Rule was vacated in 2025, but expect renewed rulemaking and stricter state privacy and disclosure requirements. Chinese EVs remain constrained by tariffs and potential software restrictions, which stabilizes used EV pricing and supports domestic supply. Dealers that integrate AI into CRM, pricing, and compliance workflows, and that harden local authority signals, will win more “near me” and answer-engine queries.

Why now

- CARS Rule vacatedin early 2025, but the FTC can re-propose via a fresh process. Do not treat this as a repeal of transparency. Build durable, auditable processes now.

- Digital retailing adoption continues to climb. More dealers can complete every step online, and buyers who complete steps online close at higher rates with shorter in-store time. Expect this to be standard in 2026.

- Rates and affordability. Fed cuts in late 2025 reduce pressure, but auto loan rates stay elevated relative to pre-2022. Plan for steady, not swift, relief through 2026.

- Tariffs and China risk. 100% tariffs on Chinese EVs plus proposed connected-vehicle software limits reduce direct low-cost imports into the U.S., shaping inventory and residual values through 2026.

- Digitization outcomes. Dealers investing in end-to-end online experiences report better close rates and customer satisfaction; 69% say customer demand drives adoption. This advantage widens in 2026.

2026 Digital Retail and AI: From Projects to Outcomes

What changes in 2026

- AI-assisted retail is table stakes. Chat, lead scoring, and automated follow-ups move from pilots to standard operating procedure. Expect higher close rates when steps are completed online and fewer abandoned deals due to faster answers and financing clarity.

- Data integrity becomes the blocker. The biggest friction is still inconsistent data between website, marketplace, and showroom. 2026 leaders invest in unified data pipelines and CDPs to stop customers from re-doing steps in store.

- AEO/GEO moves from optional to required. Structured answers on inventory, financing, fees, warranties, and service hours improve visibility in AI assistants and Local results.

Actions to ship before Q2 2026

- 1Full step-through online: price, taxes, F&I menu, trade-in, credit app, appointment select. Publish clear “what happens next” copy.

- 2LLM-readable content: FAQ blocks, policy explainer pages, finance glossary, all with clean headings and schema.

- 3AI in CRM/DMS: automated routing, SLA timers, no-lead-left-behind sequencing, and audit trails for compliance reviews.

Market and Operations: Margin Math for 2026

- Affordability stabilizes slowly. Fed policy signals easing, but rates remain higher than the 2010s. Used buyers stay payment-driven. Stock vehicles that hit key payment bands and advertise by monthly payment with disclosures.

- Fixed ops carries the profit narrative. As buyers keep vehicles longer, service and parts remain elevated. Build capacity planning, pickup and delivery, and subscription maintenance.

- Inventory strategy. With Chinese EV imports constrained, EV residuals are less volatile than they would otherwise be. Source mainstream hybrids and reputable used EVs with clear battery health data.

Compliance in 2026: Treat Transparency as Permanent

- TheFifth Circuit vacated the FTC CARS Ruleon procedural grounds, not substance. Expect the FTC to restart rulemaking via ANPRM in 2026. Keep price transparency, add-on clarity, and record-keeping disciplines in place.

- State pressure riseson privacy and disclosures. Maintain permissioned data flows and clear opt-ins across marketing, finance, and service.

- Right to Repair debatecontinues. Federal “REPAIR Act” reintroduction in 2025 and the Massachusetts telematics law keep access to repair data in the spotlight. If data-access rules broaden, independents that market service will benefit.

Consumer Expectations and Competition in 2026

Shoppers want speed, clarity, and personalization. High-pressure tactics lose. Direct-to-consumer OEM models remain competitive, but independents can win locally with trusted service, transparent F&I, and community reputation.

Execution plan

- Real-time pricing and paymentson VDPs with taxes and fees estimated by ZIP.

- F&I educationvia short videos and plain-language checklists.

- Service pathwaysthat integrate online booking, parts availability, and ride-share credits.

GEO/AEO Implementation Checklist for Car Dealers

- 1Google Business Profile: services, categories, products, pricing ranges, inventory highlights, seasonal offers, and Q&A seeded with top queries.

- 2Schema: AutoDealer, Vehicle, FAQPage, Service, Organization, LocalBusiness, Review. Keep NAP exact across directories.

- 3Answer Pages: “Fees and add-ons explained,” “Financing and payment calculator,” “Service menu and turnaround times,” and “Battery and hybrid system inspection.”

- 4AEO Content Hygiene: plain-language headings, short answer summaries, location modifiers, and a policy hub with effective dates and contacts.

- 5Omnichannel Data Integrity: unify website, marketplace, and showroom data to avoid step duplication and time waste.

FAQs

Share this article

Help others discover this content